Very Unhappy Markets

November 24, 2025

Market Roundup for the Week

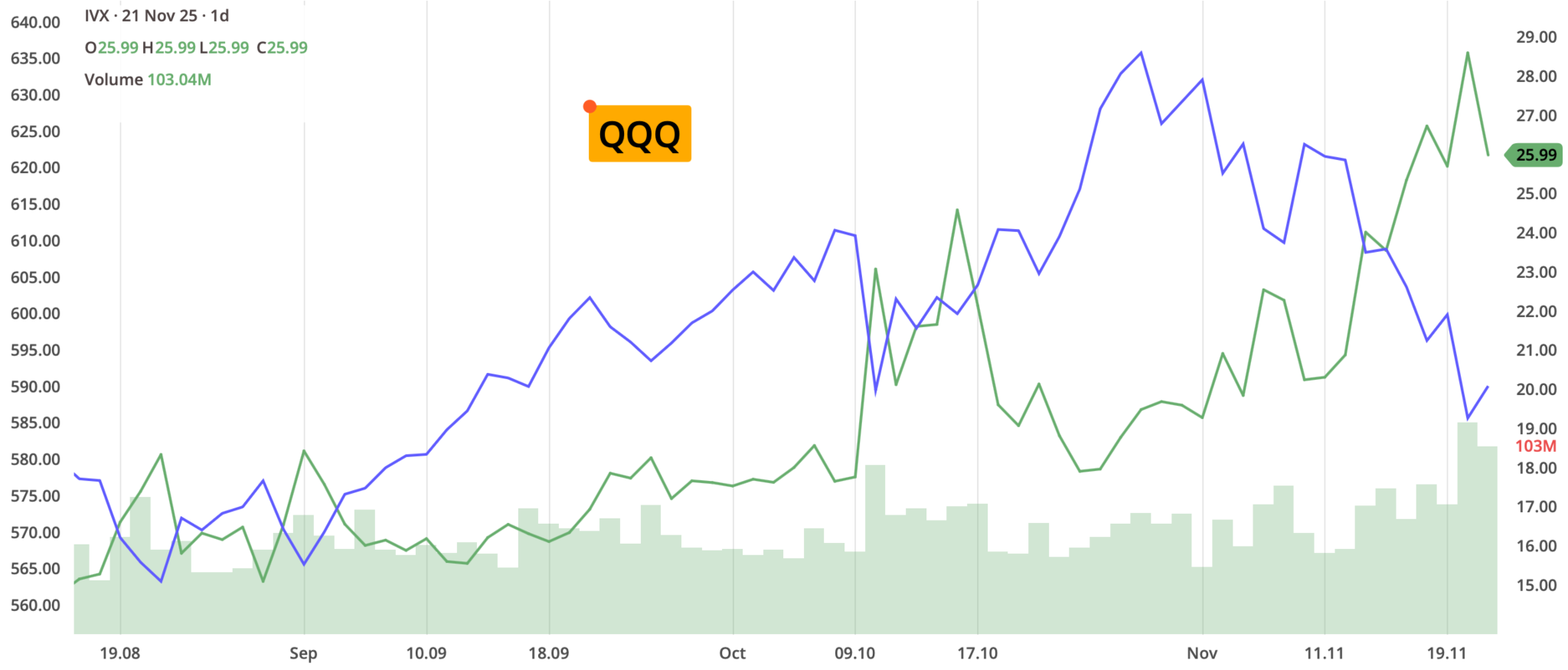

It seems that when markets are trending higher, good news is embraced and bad news is dismissed and the opposite is true for trending lower... there appears to be a definite change in sentiment, particularly in regard to technology stocks, crypto currencies and AI-related ULs.

All three indices recorded weekly losses, indicating that the selling pressure was widespread across large, blue-chip, and small-cap companies.

The IWM (Russell 2000) posted the smallest percentage loss at -0.32%. While still negative, its relative performance suggests small-cap stocks held up better than the mega-cap and large-cap names that dominate the S&P 500 and DJIA.

The SPY (S&P 500) and DIA (DJIA) were the weakest performers. This aligns with the notable market losers of the week, many of which were large-cap technology and hardware names that saw sharp declines after analyst downgrades regarding profit margins.

The Invesco QQQ Trust (QQQ), representing large-cap growth and technology stocks, was the largest loser for the week. The sector faced major selling pressure due to analyst downgrades and growing investor anxiety over the high valuations of several major hardware and semiconductor companies. This indicates a "risk-off" rotation away from high-beta growth stocks.

The SPDR Gold Trust (GLD), which tracks the price of gold, showed a nearly flat performance, closing marginally higher for the week. Gold acts as a traditional safe-haven asset. While the stock market volatility (QQQ's decline) typically supports a stronger move higher for gold, the gains were muted, suggesting a mixed market signal. Gold had seen strong performance in the preceding months due to global geopolitical risks and inflation concerns.

The IShares 20+ Year Treasury Bond ETF (TLT), which is highly sensitive to interest rate changes and recession expectations, closed with a small gain. This modest rally is consistent with the "risk-off" environment, where investors sell stocks (QQQ) and seek the perceived safety of US long-term government debt (TLT).

The week saw a clear de-risking event, with money flowing out of the highly-valued technology sector and cautiously moving into safe-haven assets like long-term bonds, with gold holding steady. In short, it was a volatile and negative week for the US market, with large-cap stocks experiencing the most significant downward drag.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

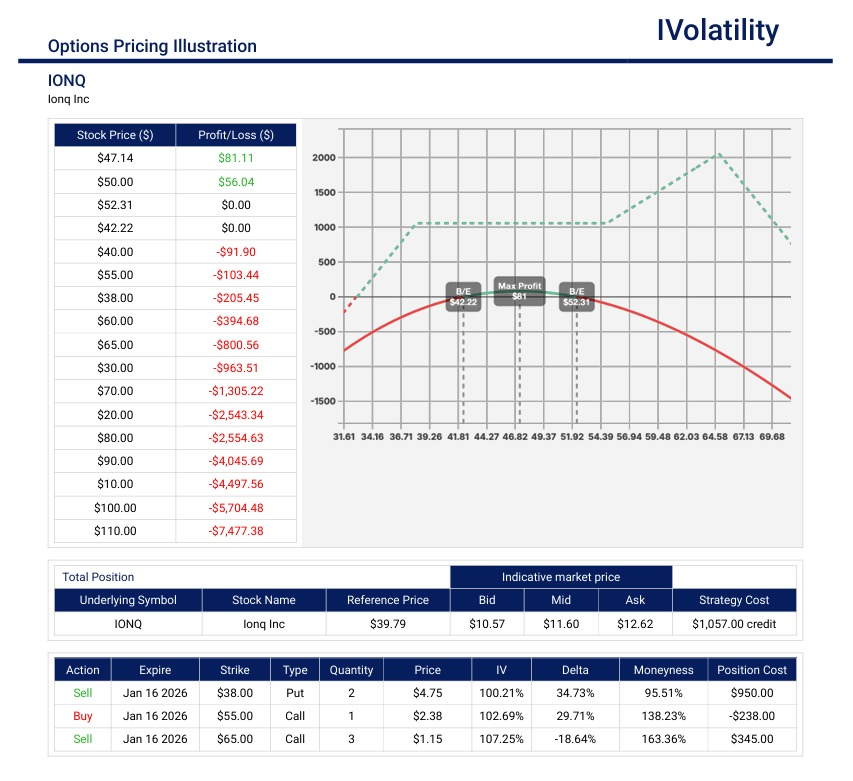

- IONQ (closed at 41.72 on Friday, Nov 21st)

IONQ is a leading company in the field of quantum computing. Its primary business is to develop, build, and make available high-performance quantum computers for commercial, academic, and government applications.

If an options trader would like to get bullish in this underlying, the following ratioed strangle position might be considered.

Sell TWO Jan16 38puts / Buy ONE Jan16 55 call / Sell THREE Jan16 65calls.

Total premium about $1000

Buying Power withheld about $880

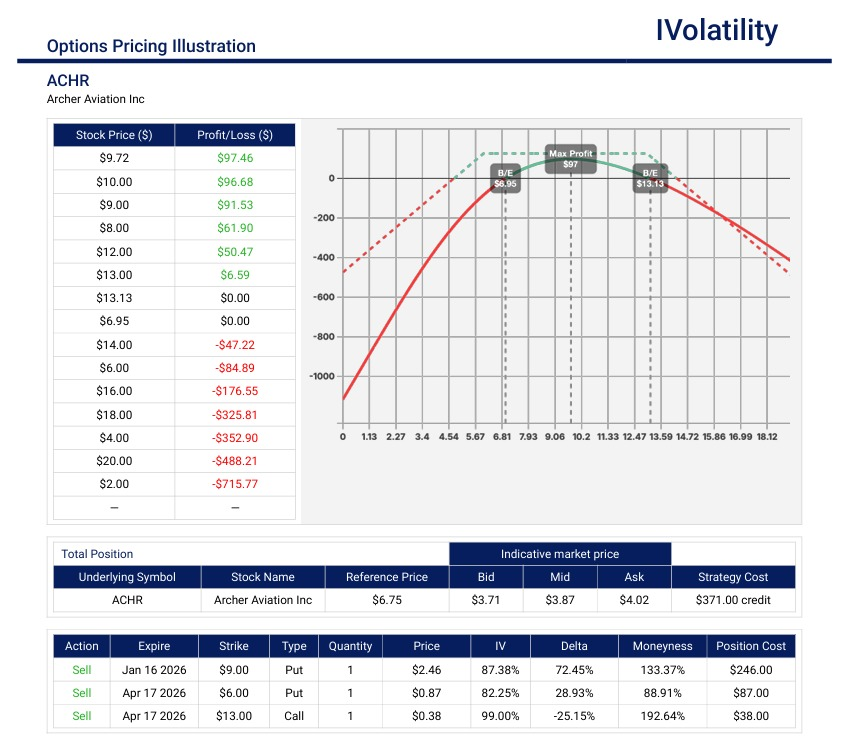

PnL Calculator from the IVolLive Web - ACHR (closed at 7.16 on Friday, Nov 21st)

Archer Aviation is a company that designs and develops electric vertical takeoff and landing (eVTOL) aircraft.

If an options trader would like to get bullish in this underlying, the following staggered strangles position might be considered.

Sell the Jan16 9put / sell the Apr17 6put / sell Apr17 13call

Premium collected $350 / contract

PnL Calculator from the IVolLive Web

Movement of the Major Indices:

These numbers are reporting the tradable activity from the opening on Monday, Nov 17th to the closing on Friday, Nov 21st (any gaps over the weekend are not included).

| INDEX | UP | DOWN |

| SPY | -1.59% | |

| QQQ | -2.68% | |

| IWM | -0.32% | |

| DIA | -1.73% | |

| GLD | 0.07% | |

| BTC/USD | -9.68% | |

| TLT | 0.47% | |

| Crude Oil | -4.29% | |

| VIX | 4.69% |

Movement of the Major Sectors:

| INDEX | UP | DOWN |

| XLK | -2.75% | |

| XLF | -1.25% | |

| XLV | 0.25% | |

| XLY | -1.82% | |

| XLI | -1.57% | |

| XLP | 0.80% | |

| XLE | -1.75% | |

| XLU | 1.5% | |

| XLB | -1.07% | |

| XLRE | 0.75% |

Notable S&P gainers for the week of Nov 17th - 21st:

The week was marked by high volatility, especially in the tech sector, but several stocks and specific sectors managed to deliver notable gains driven by positive corporate news and successful earnings reports.

Alphabet: The stock hit an all-time high after Warren Buffett's Berkshire Hathaway disclosed a new $4.3 billion stake in the company in its Q3 13F filing. This massive vote of confidence from a legendary investor sparked a strong rally early in the week.

The Gap: Shares surged after the apparel retailer reported solid third-quarter results and raised its full-year guidance, leading to an immediate analyst upgrade (e.g., from Barclays).

Intuit: The company saw its shares rise after its earnings report, where the company highlighted that AI integration was successfully boosting its sales and product growth.

YUM: Upgraded to "Buy" by analysts who cited the potential sale of the Pizza Hut division as a positive catalyst that would allow the company to focus on high-growth segments like Taco Bell.

Zymeworks: Soared after announcing positive Phase 3 results for its drug Ziihera® in treating gastroesophageal adenocarcinoma, positioning it as a potential new standard of care.

Jazz Pharmaceuticals: Gained on positive data related to its partner, Zymeworks, and its work in the oncology space.

Nuvalent: NUVLThe stock moved higher following positive data from their pipeline, reflecting broader investor interest in promising oncology assets.

Notable S&P losers for the week of Nov 17th - 21st:

The week of November 17 – 22, 2025, saw significant volatility and selling pressure, particularly across the technology and cryptocurrency-related sectors, leading to several notable losers.

The overall sentiment was driven by growing anxiety over AI stock valuations ahead of a key earnings report, as well as several negative analyst ratings and broader concerns about the economy following the end of a government shutdown.

The overall market performance was mixed to negative, with the Nasdaq and S&P 500 experiencing a "sell-the-news" event following a highly anticipated AI earnings report, as investors decided to reduce exposure to the volatile tech/AI sector. Concerns about high valuations and macro uncertainty persisted throughout the week.

Dell Technologies: Double-downgrade by Morgan Stanley, citing soaring memory chip prices that would negatively impact gross margins. Shares dropped over 8% on Monday.

HP Inc.: Downgraded by Morgan Stanley for similar margin pressure concerns in the PC/printer space.

Micron Technology: Tumbled nearly 11% on Thursday, likely in sympathy with broader semiconductor weakness and the fading of a rally that occurred after a key AI earnings report.

Advanced Micro Devices: Slumped nearly 8% on Thursday as the post-earnings enthusiasm around AI hardware faded and general risk-off sentiment took hold.

Coinbase Global: The crypto exchange operator fell around 7% as Bitcoin extended its losing streak.

Robinhood Markets: Dropped around 10% on Thursday amid the general risk-off sentiment and falling crypto prices (which they offer trading on).

Expedia Group: Lost nearly 8% after Google launched new AI travel tools that could bypass OTA platforms.

Booking Holdings: Shares moved lower on similar competitive fears from new tech offerings.

Major US Airlines: DAL, UAL, AAL and LUV all declined 3% to 5.5% early in the week despite the government shutdown ending and flight restrictions being removed, indicating broader market weakness.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Warren Buffett doesn't usually swipe right on big tech – but Alphabet got the match. Berkshire Hathaway bought 17.8 million shares of the big tech behemoth during the third quarter, a stake valued at about $4.3 billion at the end of Q3, making it the firm's 10th-largest equity holding. Alphabet rose over 3% today on the news. Alphabet trades at the lowest P/E ratio among the Magnificent Seven (25x vs. an average of 35x) and continues to generate strong free cash flow as peers burn through cash investing in AI.

Investors entered the workweek very worried and the S&P 500 tumbled for a third straight day, falling below its 50-day moving average for the first time in 138 trading sessions, the second-longest streak in market history.

All eyes were firmly glued on Nvidia's earnings report Wednesday evening, followed by a delayed September jobs report on Thursday – two make-or-break moments for the market.

Novo Nordisk cut Ozempic and Wegovy's price tags to $349 for direct-to-consumer patients.

The Harvard endowment's biggest holding is a bitcoin ETF.

Ford and Amazon announced a collaboration on a new program to let dealers sell used vehicles online.

Jeff Bezos will be co-chief executive of a new AI startup called Prometheus.

Monday's Movers to the Upside:

- Jazz Pharmaceuticals and Zymeworks posted strong Phase 3 results for their cancer drug Ziihera, which improved progression-free survival in patients with gastroesophageal adenocarcinoma. Jazz rose over 20%, while Zymeworks soared nearly 30%.

- Quantum Computing climbed nearly 8.5%, boosted by impressive revenue growth driven by hardware contracts and cloud-access demand.

- E.W. Scripps skyrocketed nearly 40% after Sinclair disclosed an 8% stake in the broadcast station company.

- Vita Coco rose over 3.5% on guidance that tariff impacts will be less severe than previously expected.

- Brinker International gained nearly 7% after Stifel reiterated its "buy" rating on the stock, putting the Chili's parent on track for its biggest one-day rally since April.

Monday's Movers to the Downside:

- Dell Technologies and Hewlett Packard Enterprise slipped 8.42% and 6.97%, respectively, as Morgan Stanley cut the stocks to underweight.

- Robinhood Markets fell over 5% and Coinbase lost over 7% as the digital asset selloff dragged crypto stocks down with it.

- Strategy is buying the dip: The company revealed it bought 8,178 bitcoins last week. Investors didn't approve, and shares fell 2.17%.

- Xpeng dropped over 10% after the Chinese EV maker reported a bigger loss issued weaker-than-expected fourth-quarter guidance.

- Food and service facilities provider Aramark slid over 5% as the company came up short on both fourth-quarter earnings and revenue.

- Rocket Lab declined nearly 5%, extending its losing streak as investors continued to digest news that the debut of its Neutron medium-lift rocket has been delayed from late 2025 to 2026.

Tuesday's Markets and News:

Investors continued to fret over how highly valued AI stocks are, and how blind the Fed is flying without government data.

Bitcoin briefly fell below $90,000 this morning – a level it hasn't sniffed since April. The crypto king had returned 30% this year through October, but the recent sell-off means bitcoin is now down over .50% year to date.

Saudi Arabia is gearing up to announce a bunch of AI deals with US firms like Amazon, AMD, and xAI.

Google unveiled Gemini 3, its latest upgraded AI model.

Meta Platforms won its antitrust case against the FTC, with a judge ruling that the company does not have a monopoly over the social media market.

Larry Summers is stepping back from public commitments in the wake of email exchanges with sex offender Jeffrey Epstein.

Tuesday's Movers to the Upside:

- Warner Bros. Discovery rallied over 4% on reports that Paramount Skydance is preparing a $71 billion bid for the entertainment giant.

- Rheinmetall jumped over .50% as the German defense giant said it expects sales to grow fivefold over the next five years, fueled by surging global demand for weapons systems amid rising geopolitical tensions and the war in Ukraine.

- Intuit climbed over .50% on news it's paying OpenAI more than $100 million a year to power new AI agents.

- Merck rose nearly 4% following positive trial results for a heart drug the company sees as a major driver of future growth.

- Medtronic gained nearly 5% after it beat fiscal second-quarter earnings expectations and raised its fiscal 2026 revenue growth outlook.

Tuesday's Movers to the Downside:

- Battery maker Energizer Holdings tumbled over 18% as weak Q4 results and a sharply lower outlook due to tariffs spooked investors.

- Payment processing company Klarna slipped over 9% after a $95 million quarterly loss overshadowed its revenue beat.

- PDD Holdings fell over 7% as its 9% revenue growth last quarter highlighted a clear slowdown from its hyper-growth years.

- Logistics company, Ceva, dropped over 14% after announcing a dilutive 3 million-share public offering.

Wednesday's Markets and News:

Indices clawed their way out of the red throughout the afternoon as anticipation built heading into Nvidia's earnings report this evening.

Minutes from the last FOMC meeting in October indicated that while central bankers mostly support more interest rate cuts, they may keep rates unchanged for the rest of the year.

Bitcoin plunged below $90,000, continuing its dramatic slide as investors become more risk-averse.

Larry Summers resigned from the board of OpenAI after revelations about the famed economist's email exchanges with sex offender Jeffrey Epstein.

Walmart is in talks to acquire R&A Data, an Israeli tech startup that monitors for scams.

The US trade deficit narrowed roughly 24% in August from the month prior as global tariff rates set in.

The BLS announced that the full October jobs report will not be released, and the agency will instead include what data it has in the November jobs report.

Wednesday's Movers to the Upside:

- Alphabet rose nearly 3% as investors cheered Google's new Gemini 3 AI model, which delivers more accurate answers to complex questions and requires far less prompting for context.

- Constellation Energy climbed over 5% after the Department of Energy approved a $1 billion federal loan to help reopen the Three Mile Island Unit 1 nuclear plant.

- Lowe's gained over 4% on a Q3 beat across earnings and revenue, standing in contrast to Home Depot's disappointing results.

- Dycom advanced over 10% following a Q3 beat and the announcement of a $2 billion acquisition of Power Solutions to expand into data-center construction.

- MP Materials soared over 8.5% after signing a binding agreement with the Pentagon and Saudi miner Maaden to build a rare-earth refinery in Saudi Arabia.

Wednesday's Movers to the Downside:

- MP Materials soared over 8.5% after signing a binding agreement with the Pentagon and Saudi miner Maaden to build a rare-earth refinery in Saudi Arabia.

- Williams-Sonoma slipped nearly 3.5% despite delivering a beat-and-raise earnings report.

- Boeing fell over 2% despite strong order activity at the Dubai Air Show, with investors zeroing in on shrinking free-cash-flow estimates.

- DoorDash dipped over 4.5% as Q3 results raised concerns about heavier 2026 investment plans, though Jefferies upgraded the stock to Buy from Hold.

- Bullish declined over 3.5% even with a Q3 beat, as bitcoin's slide back below $90,000 weighed on sentiment across the crypto sector.

Thursday's Markets and News:

Wild day in the market with ominous undertones, for sure. The substance of NVDA's earnings report did not seem to matter for more than a couple of hours! There appeared to be a gathering of momentum in the sentiment shift downward...

Markets started the day strong following Nvidia earnings, but a surprisingly solid jobs report curtailed hopes of a Fed rate cut next month. That put a damper on the day, and indices had their biggest single-day reversal since April.

The CBOE Volatility Index soared as investors realized that tech companies taking on debt to build data centers with no easy monetary policy anytime soon may be viewed as AI valuation concerns not going anywhere soon.

Spot bitcoin ETFs ended five straight days of outflows yesterday, helping bitcoin recoup some of its recent losses this morning – until investors got risk-averse once again and pushed the crypto even lower.

Famed investor Ray Dalio said we are definitely in an AI bubble but gave reasons to not sell at this point.

Google just announced its latest AI image generation tool, and yes, it is called Nano Banana Pro.

Cracker Barrel shareholders voted to keep the company's CEO, but ousted board member Gilbert Dávila after its disastrous rebranding.

Starbucks workers are escalating their strike amid the holiday season.

Thursday's Movers to the Upside:

- Topgolf Callaway Brands is going to have to change its name: The golf company sold a majority stake of its Topgolf brand to a private equity firm for $1.1 billion. Shares rose nearly 4%.

- Exact Sciences jumped nearly 17% following Abbott Laboratories's agreement to acquire the at-home colon cancer test maker in a $21 billion deal.

- IBM rose just over 0.5% after announcing plans to build a network of quantum computers alongside Cisco, aiming to connect systems over longer distances by the early 2030s.

- Healthcare company PACS Group soared over 55% despite missing EPS as it beat revenue and sharply raised its outlook.

- Oddity Tech popped nearly 65% after the skincare company reported better-than-expected earnings and revenue and raised full-year guidance.

- Regeneron climbed over 5% after the FDA approved its new drug Eylea HD to treat macular edema.

Thursday's Movers to the Downside:

- Bath & Body Works slipped nearly 25% after the company missed Q3 estimates and cut its outlook, citing "macro consumer pressures" weighing on demand.

- Palo Alto Networks fell nearly 7.5% despite meeting Q3 expectations and announcing a deal to acquire cybersecurity firm Chronosphere, reflecting broader weak momentum across the software sector.

- Construction and engineering services provider Jacobs Solution declined nearly 11% even though it beat on earnings and revenue.

- Strategy sank over 5% as crypto fell across the board. The stock might get removed from index provider MSCI.

- Ford slid nearly 4% amid reports of a second fire in two months at a key aluminum plant.

Friday's Markets and News:

Thursday's rally unraveled, but the rebound was in full effect today as indices ended the week on a high note – though all three finished lower for the week.

Market odds of the Fed cutting interest rates next month soared from 39% yesterday to nearly 70% today after a top official said a near-term cut may be warranted.

Central bankers are truly flying blind into the December FOMC meeting after the BLS announced that it will not release October CPI figures.

Eli Lilly became the first healthcare company to join the $1 trillion market cap club, after briefly hitting the milestone this morning. It's now the second non-tech company to reach that mark, following Berkshire Hathaway.

Shoot for the stars: Google's head of AI infrastructure told employees the company must double AI serving capacity every six months to meet high demand.

Less stringent regulation on US banks is expected to generate $2.6 trillion for financial institutions.

US consumer sentiment tumbled to one of its lowest levels ever last month.

Friday's Movers to the Upside:

- Alphabet gained over 3% and surpassed Microsoft as the third-largest US company by market cap, the first time it surpassed its big tech rival since August 2018.

- Gap jumped over 8% on strong revenue fueled by a viral marketing boost from its Katseye campaign.

- Intuit rose over 4% after beating fiscal Q1 earnings and revenue estimates, and it's still enjoying a boost after announcing a $100 million partnership with OpenAI earlier this week.

- Ross Stores gained over 8% as it topped earnings forecasts and raised its full-year guidance.

- Healthcare product manufacturer QuidelOrtho climbed over 14% following CEO Brian Blaser's purchase of 23,500 shares, signaling confidence in the stock.

- Life science company Azenta advanced over 16% after delivering a fiscal Q4 earnings beat that topped analyst expectations.

- Enviri skyrocketed over 28% after announcing a deal to sell its Clean Earth waste division to rival Veolia for $3 billion.

Friday's Movers to the Downside:

- Veeva Systems fell nearly 10% despite beating earnings, as investors focused on the company landing only 14 of the top 20 biopharma firms for its new Vault customer relationship management system.

- Elastic slipped nearly 15% after posting strong results but reporting a slowdown in cloud revenue growth in the first quarter.

- Oracle dropped over 5.5% as its slump continued amid renewed fears of an AI bubble and concerns about its heavy debt load.

- Bath & Body Works sank nearly 5% following yesterday's plunge, with weak Q3 results prompting multiple Wall Street downgrades.

Notable Earnings due week of Nov 24th - 28th

The actual day may vary, so do consult with your broker to confirm the actual date. Also, if an options trader wishes to open positions to participate in earnings announcements, it's important to check whether the earnings are released BEFORE or AFTER the date of earnings.

Tuesday: ZM / BABA / DKS / BBY / BURL / KS / HPQ / DELL / ZS / WDAY/ NIO

Wednesday: DE /

Notable Economic Data due week of Nov 24th - 28th

This week is shortened due to the Thanksgiving holiday in the US. The US financial markets will be closed on Thursday (Thanksgiving) and close early on Friday. Regardless, the week is packed with important and highly-anticipated releases, including several reports that were delayed due to the recent government shutdown.

The key focus will be on the inflation reports and consumer health data, some of which are for the earlier month of September due to the recent data delays.

Monday: Industrial Production & Capacity Utilization

- Measures factory output and how much of that capacity is being used. Key indicator of manufacturing health and potential for inflation.

Tuesday: Conference Board (CB) Consumer Confidence

- Surveys consumer sentiment about current and future economic conditions, giving insight into potential spending habits.

Tuesday: Producer Price Index (PPI) (for September)

- Wholesale inflation data. This tracks price changes from the producer's perspective, which often feeds into Consumer Price Index (CPI) later.

Tuesday: Retail Sales (for September)

- A critical measure of consumer spending, which drives a large part of the US economy. The strength of the consumer is a major market driver.

Wednesday: Durable Goods Orders (for September)

- Measures new orders placed with manufacturers for long-lasting goods. A key gauge of business investment and economic confidence.

Wednesday: Initial Jobless Claims

- The most timely reading on the health of the labor market, showing how many people filed for unemployment benefits for the first time.

Wednesday: (Tentative/Delayed) Personal Income & Spending

- Includes the PCE Deflator, which is the Federal Reserve's preferred measure of inflation. Note: This is subject to delay following the government shutdown.

Closing Thoughts

Not everyone is riding the AI wave. Peter Thiel's Thiel Macro dumped its entire Nvidia stake, a position that accounted for about 40% of the fund's equity portfolio. That exit echoes a broader shift: SoftBank also unloaded its Nvidia position last month, and Michael Burry's Scion Asset Management disclosed put options on the stock as of Sept. 30.

Some investors see signs of an AI bubble, especially after Nvidia briefly brushed a $5 trillion valuation in October. Others flag structural concerns beneath the surface: Burry, for instance, has criticized hyperscalers like Microsoft and Alphabet – the very companies buying Nvidia's chips – for using extended depreciation schedules that artificially suppress reported expenses and inflate profits.

Investor sentiment around AI has turned cautious. The Magnificent Seven have collectively fallen about 5.8% since the end of October as doubts build around stretched valuations and slowing momentum.

A new crypto winter appears to be on the horizon. Bitcoin's rapid decline over the past month has completely erased its year-to-date gain, pushing the king of crypto to its lowest level since April. While Wall Street's acceptance sparked the crypto's surge at the beginning of the year, anxiety about the macro environment and the Fed opting not to cut rates drove a sharp sell-off in mid-October. So sharp, in fact, that $1 trillion in market value was wiped out across various tokens on Oct. 10 alone, according to Bloomberg.

Bitcoin hit a death cross this weekend, sparking fears that have now spread to the altcoin corner of the digital asset market.

Over the weekend, the MarketVector Digital Assets 100 Small-Cap Index, which tracks the 50 smallest digital assets, plummeted to its lowest level since November 2020, according to Bloomberg.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.