Last Week’s Highlights at IVolLive:

- Register HERE for our next free, live webinar that we will be hosting tomorrow at 12 Noon EST. This webinar is titled Leverage the Real Time Option Spread Scanner to find Profitable Spread Option Trades in All Market Conditions - PART II.

- It's no secret that the market has been incredibly volatile recently, which can make traders and investors nervous. What's great about the RT Spread Scanner is it's a robot - it will find potentially profitable trade setups regardless of market conditions.

- On Saturday, our experts gave a LIVE walkthrough and demo on the IVolLive platform, including how to trade puts, calls, and spreads as well as how to add features like stocks, charts, the Stock Monitor, and the Profit and Loss Calculator. Watch the video HERE.

- You can register for any of our upcoming LIVE webinars HERE.

- You can watch and view any of our past videos on our YouTube channel HERE.

- Register for a free IVolLive Trial HERE.

And the Q1 Winner Is...

April 3, 2023

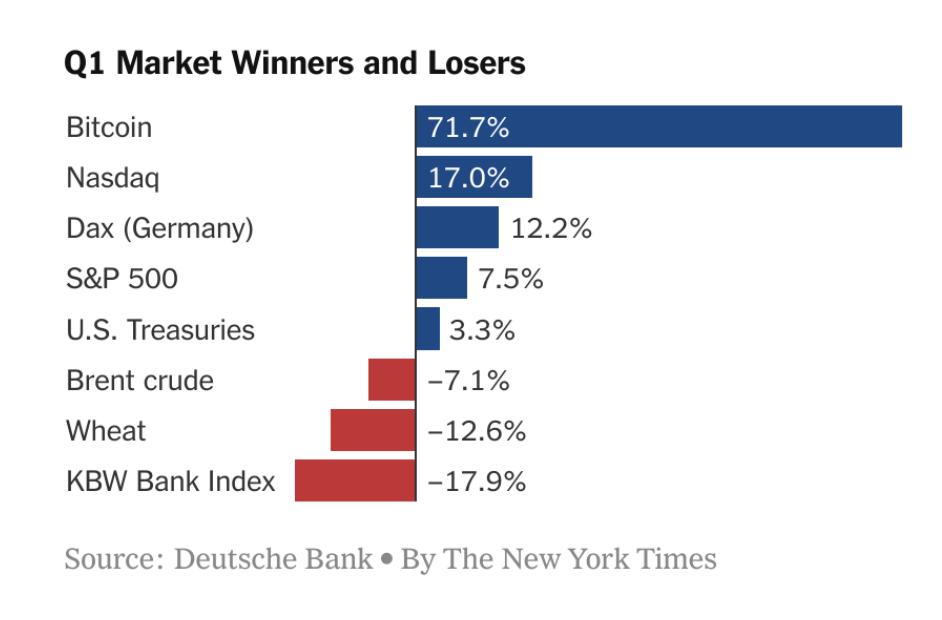

The first quarter of the year has come to a close. After a tumultuous 2022, which asset classes were the winners (and losers) for the quarter? Drum roll...

Despite increased regulatory scrutiny and drama, Bitcoin was the top performing asset class of the first quarter. Following the king of crypto was the tech-heavy Nasdaq (which officially entered bull market territory as of Friday's close), German stocks (the Dax), and boring (usually) U.S. Treasuries – which were anything but boring following heavy drama and intrigue around interest rates and inflation.

We've featured many of these trends in these pages, including the action in the CBOE Volatility Index (the "VIX" aka "fear gauge"). Here's a Q1 chart of the VIX from IVolLive.

With this chart, we can see that last quarter, the VIX bounced in a ten-point range between 18 and 28, peaking on March 13th, and approaching its Q1 lows of 18.

Investors are rotating out of stodgy industrial stocks and into tech names as revenues remain high and cost-cutting measures go into effect.

Time will tell if this trend continues...

Summing Up

The first quarter of 2023 is officially in the books. Investors are breathing a collective sigh of relief that despite continues interest rate drama, crypto escalation, and the back-and-forth battle against inflation, the market has remained resilient.

Trends were looking at as we go into the second quarter:

- Continued strength in the tech sector

- Gold's resilience

- A rising VIX even while stocks also rise

- Discrepancies between large cap stocks' implied volatility and historical volatility

Previous issues are located under the News tab on our website.