Last Week’s Highlights at IVolLive:

- Don't forget to register for our next live webinar on Tuesday, September 5th 2023 Webinar Topic: P&L Calculator - harness this powerful tool to analyze the potential profit and loss of any option trade. HERE

- Get a free IVolLive Trial HERE.

Is Volatility Poised to Return to the Market?

September 1, 2023

And just like that, summer is coming to a close. We've officially entered September... and - historically - volatility season.

You see, the summer months are typically slow, griding months for the market. It drifts higher or lower on lower trading volumes as the large traders soak up vacation time away from their trading desks.

But after Labor Day, all of that changes. The large traders are back - and this almost always translates to larger trading volumes... and volatility.

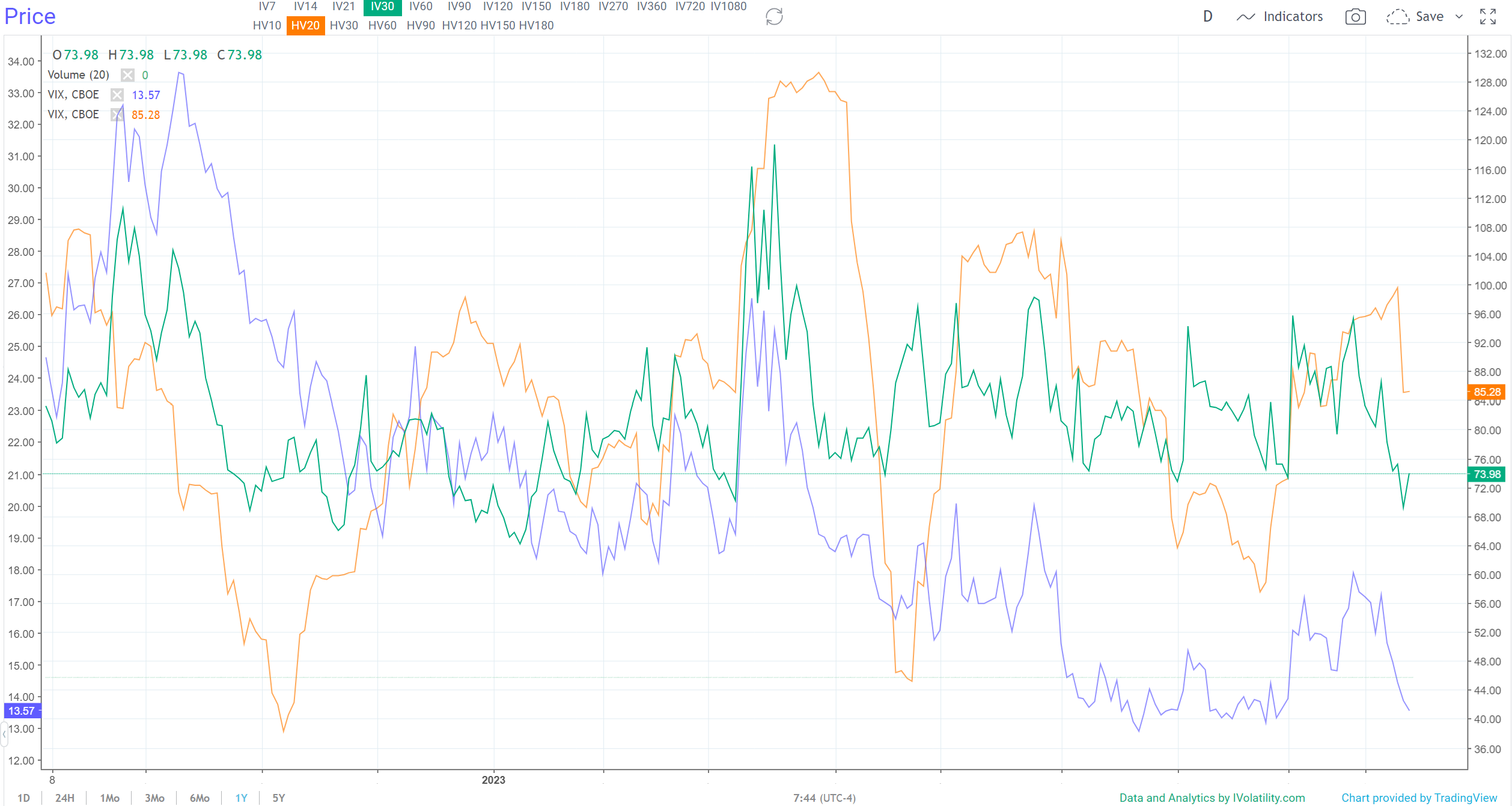

For proof of this trend, check out this one-year chart of the market's "fear gauge", the VIX:

With this chart we can see a few things:

• Price is in blue. About a year ago, in September 2022, the VIX spiked as high as a reading of 34 - nearly double its current reading. If we get back to those levels, expect that to correspond with a major uptick in market volatility.

• Historical Volatility (HV) is in orange. You can see the inverse relationship between HV and price.

• Implied Volatility (IV) is in green. This measure gives us a hint as to the future direction of the VIX. When it spikes, that typically means the VIX is about to rise; when it drifts lower, the VIX typically bleeds lower as well (which corresponds with a rising market).

If you look closer, you can see that recently, the VIX's IV has turned higher (again, the green line). This could be an early warning sign that the slow drift lower for the VIX is preparing to turn around.

This would translate to a spike in the VIX's spot price - which, again, almost always corresponds to a downturn, or at the very least a rise in volatility, in the stock market... and thus, an increase in options premiums.

How to Play It

The return of volatility will create a target rich environment for traders. This means trade setups that haven't made sense financially (due to cheap premiums) could come into play.

From where we sit, we're looking for opportunities in:

• Big energy - we're following the rebound in crude oil prices closely, and how that translates into price action for the majors like Exxon and Chevron

• Big Tech - tech has been strong all year. It's recently retraced, and there could be opportunities to go short if the downtrend continues into the fall/winter. We're watching names like Apple, Microsoft, and Facebook/Meta

Previous issues are located under the News tab on our website.