Are You Tempted to Play the Meme Stocks?

May 16, 2024

The Markets at a Glance

New Highs - Now What?

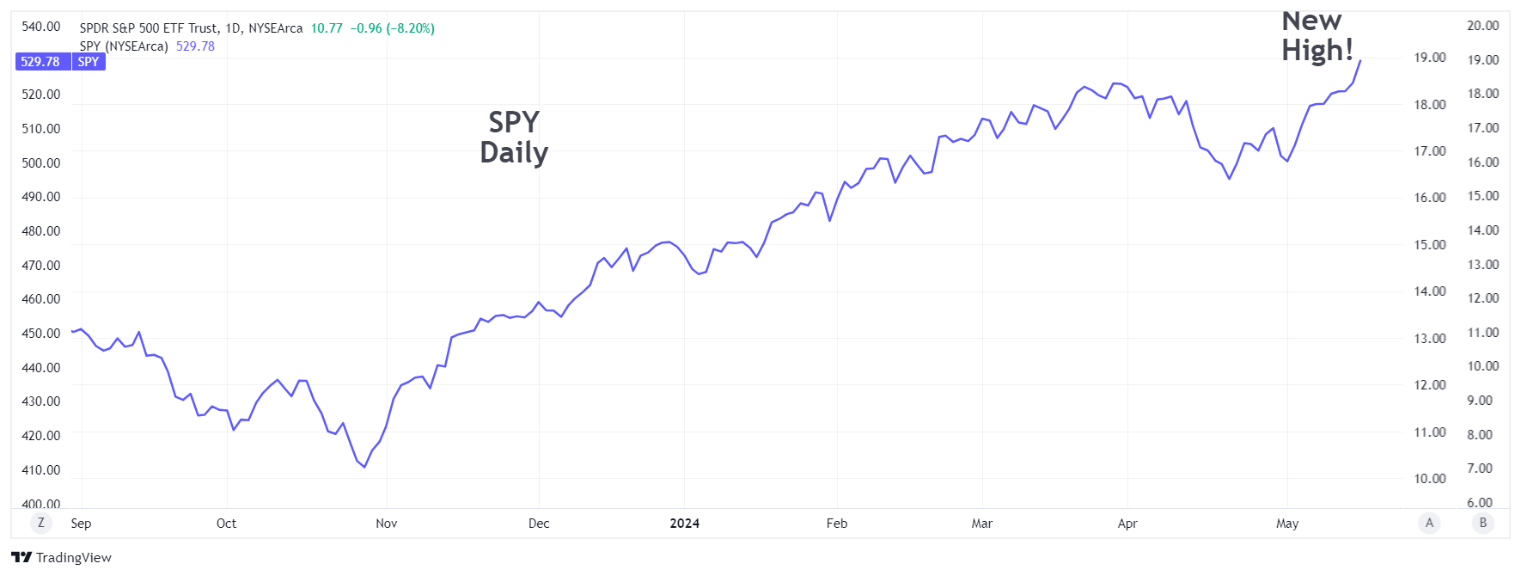

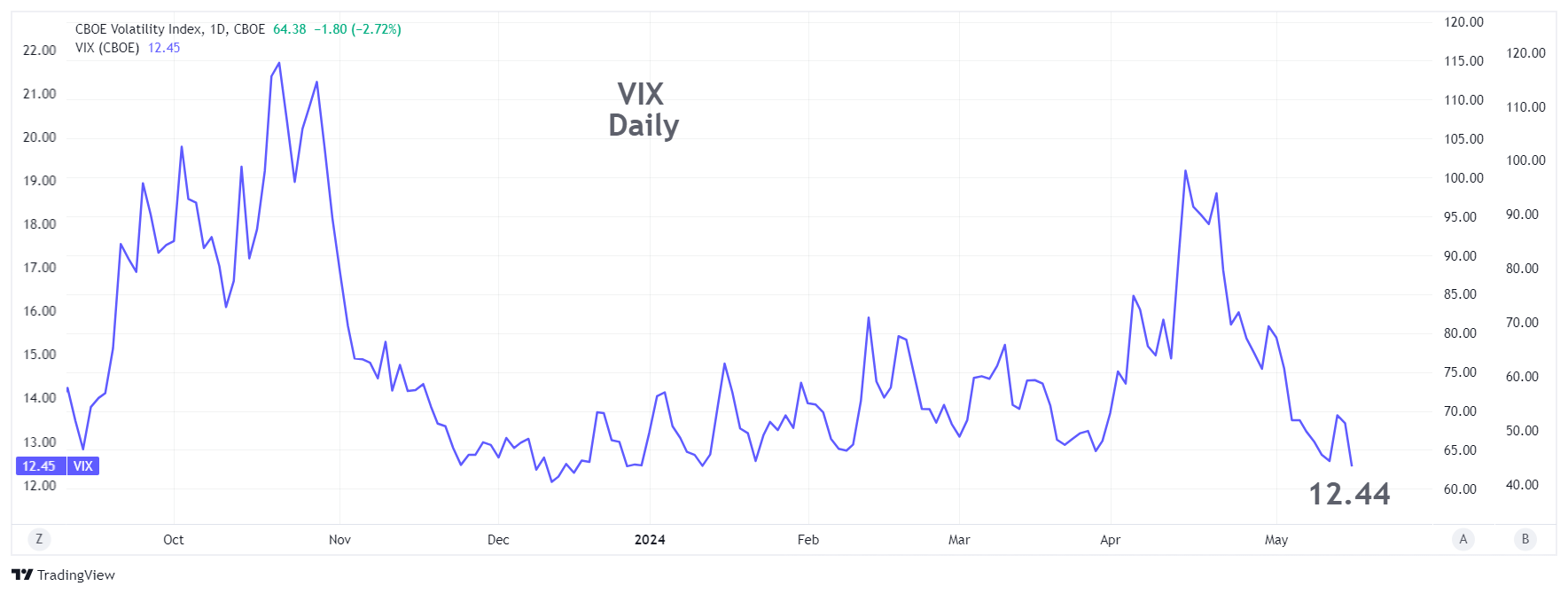

The market showed its hand this week by rising to new highs and sinking to levels of implied volatility not seen since January. Helped by a somewhat benign CPI number which suggests that inflation may be moderating after all, SPY reached a new high yesterday (on Wednesday) at 529.78. QQQ did likewise at 452.90.

This makes it rather difficult to maintain a bearish outlook, except perhaps for a short-term pull-back within the larger upward trend. With respect to the uptrend from October 2023, the latest move is either a new uptrend that started after the early April correction or potentially a continuation of the uptrend from October that incorporates the April selloff as an in-trend correction.

All of this recent action follows a lukewarm earnings picture and no news yet from the Fed on interest rate cuts this year. We are also entering the traditionally slower half of the year (May through October). And while the market is climbing higher, defensive money is still going into US Treasuries, Utilities stocks, and Gold, all three of which were also up today.

The strength of the overall market also formed an optimistic backdrop in which the so-called "meme" stocks like GME and AMC and newcomer SPWR could come alive and exhibit massive spikes upward in price.

Strategy talk: Options on Meme Stocks

Option players love special situations, big stock moves, and juicy option premiums. That makes it hard to resist the meme stocks, though we should all be well aware by now that their occasional moonshots in price are just a passing game between a Reddit army of small traders and a handful of hedge funds. The traders manage to make brief advances against the hedge funds, but in the end, they cannot keep a stock aloft forever with prices way beyond what the fundamentals will justify.

The chart below shows the original surge in GME in 2021 and the gradual decline since then, leading up to the surprise upside move this week. While it is clear that the 2021 move was an exaggerated spike (from single digits to more than 80), the stock has been in a long decline for nearly 3 years now, until this week, when it popped again.

The question is how can an option trader capitalize on stocks that act this way. Buying long puts is typically rejected, as the implied volatility causes them to be outrageously priced. Also, the surprising feature of GME's price performance was how long it remained over 40 (almost a year) and over 20 (almost another year). This would further render any long-put strategy a losing proposition.

Put bear spreads are a possibility, though they, too, would be expensive and would require a long enough expiration to become profitable.

Credit call spreads could work at certain times, but there were several spikes during 2021 from 40 back up to 60, which could wreak havoc on call spreads.

In addition, there are several other challenges facing option traders here:

• Because of the unpredictability of the stock price, market makers will tend to widen their bid-ask spreads, making it very challenging to get a reasonable execution.

• The stocks are subject to numerous trading halts, which further hinders the ability to get a trade executed.

• The price of the stock and the options on a daily basis can be a rapidly moving target

Generally, I am steering clear of GME, but I did manage to purchase one put butterfly spread for Friday 5/17 at the 45/35/25 strikes (long one 45 put, short two 35 puts, and long one 25 put) for $2.60. The problem is that I will need to wait until late Friday to close it and who knows where it might be by then?

AMC, on the other hand was a stock trading between 2.5-3.5 for weeks that spiked to 11.88 but then backed off to close at 5.48. Since AMC pulled back quite a bit already, I concluded that there wasn't as much downside risk, yet the options were still quite elevated. So, for AMC, I put on a simple covered call write for 5/17 at the 4.5 strike for a net price of $4.17. I figure I can be happy with 8% gain for a few days if the stock is above 4.5 on Friday and I always have the ability to roll it forward if it still looks attractive.

So, the bottom line on meme stocks is (if you decide to play them at all) to take advantage of the expensive option premium but without taking too much directional risk or having to wait too long for your result. If you try to outguess the stock's direction, you may not only lose money, but incur a lot of anxiety in the meanwhile.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.